A dreadful thing happened yesterday. My guilty secret was almost discovered.

My husband was idly opening a letter - having failed to notice that it was addressed to me. Why on earth had I left it lying on the kitchen table?

Eek! I said, hastily whipping it out of his fingers. I think that’s mine!

Husband looked puzzled. All the more so as he had already seen the tell-tale headed notepaper: Halifax Building Society.

“Why are the Halifax writing to you?” he wondered. I shrugged oh-so-carelessly. “Oh, they’re probably just trying to sell me a credit card,” I mumbled, stuffing the evidence into my mountain of vital papers. Husband gave me a suspicious look, then ambled off.

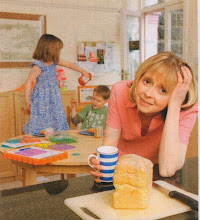

Horrors! I thought. For my husband had been about to discover that I have a stash of secret savings. So far as he is aware, all our money has been joint money for almost 20 years now. For both of us, shared money has always been symbolic: shared money means shared lives. We are in this together.

But that hasn’t stopped me from keeping a little nest egg. And the only thing that makes me feel slightly less guilty about it is that I’m not the only one. According to a poll by insurance firm Prudential, fifteen per cent of couples over 40 have a secret savings pot worth £1,037 on average. Women are more likely than men to be secret money-hoarders, with 18 per cent admitting to hiding savings averaging £1,002.

Hannah Close, a barrister friend of mine, is another member of the secret savers’ club. She has a proportion of her monthly earnings paid into a separate bank account so that she can buy things that her husband considers frivolous. “He is the type who actually checks bank statements. If he sees I’ve spent £200 on a pair of shoes, he’ll grump about it. It’s easier just to buy things behind his back. If he actually notices I’m wearing new shoes, he’s so clueless that he’ll believe that they only cost £19.99.”

This logic makes good sense to me. I would dearly love a ludicrously expensive waterproof coat and a cello. Not that I can play the cello.

More worryingly, though, 23 per cent of secret savers are keeping their own stash of cash in case they split up from their partner (which must mean that women are either less optimistic or more realistic than men when it comes to relationships). Another friend, Sian, has adopted precisely this approach. “My parents split up, and my mother was left virtually penniless. I have no intention of leaving my partner, but I think it’s sensible to plan for all possible scenarios.”

Oh dear. Is that what I’m secretly planning?

In that case, my husband will be relieved to know that my secret stash amounts to ... £67.29. Which might just about pay for a day trip to Huddersfield and back.

3 comments:

Hahaha. Brilliant! This is something I would LOVE to do. But mine would be saving for a family trip to Disneyland. I'd love to surprise them with that :) Liz xx

Ha! My secret stash amounts to about $2.65... all in 5c or 10c coins lurking in the bottom of my handbag. Not even enough to by a decent cup of coffee!!

Ha! Sneaky - I love it ;)

I have only just opened up my first bank account - and at 36 years of age I'm rather proud of that!

Will I ever save any up? Hmmm not while there are cupcakes in this world!

Post a Comment